The Lowdown on DSCR Loans...

Qualify for a home loan without using your tax returns with a DSCR loan program. As a real estate investor, you can avoid high rates and high points of private loans, lengthy approval processes, and strict lending criteria with a debt service coverage ratio loan, which is a type of no-income loan. Qualify for a loan based on your property’s cash flow, not your income.

The debt service coverage ratio (DSCR) is a number that measures a property’s current rental income compared to its debt obligations. A DSCR above 1.0 indicates positive cash flow, while a DSCR below 1.0 indicates negative cash flow.

A DSCR loan allows a borrower to qualify for financing based on the projected rental income of a property rather than personal income.

DSCR loans are designed for real estate investors and can only be used to purchase income-generating properties. DSCR loans can’t be used to buy a primary residence or a fixer-upper.

What Is the Debt Service Coverage Ratio (DSCR)?

The debt service coverage ratio measures a property’s annual gross rental income against its annual mortgage debt, including principal, interest, taxes, insurance, and HOA (if applicable). Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property and to determine how much income coverage there will be at a specific loan amount. When calculating DSCR, lenders do not take into account expenses such as:

- Management

- Maintenance

- Utilities

- Vacancy rate

- Repairs

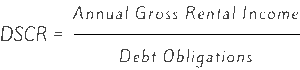

DSCR Formula Calculation

The debt service coverage ratio measures a property’s annual gross rental income against its annual mortgage debt, including principal, interest, taxes, insurance, and HOA (if applicable). Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property and to determine how much income coverage there will be at a specific loan amount. When calculating DSCR, lenders do not take into account expenses such as:

How to Calculate DSCR

The debt service coverage ratio measures a property’s annual gross rental income against its annual mortgage debt, including principal, interest, taxes, insurance, and HOA (if applicable). Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property and to determine how much income coverage there will be at a specific loan amount. When calculating DSCR, lenders do not take into account expenses such as:

Step 1

To find your gross rental income, we take your annual rental income based on your lease agreement and the appraiser’s comparable rent schedule (form 1007) and use the lesser of the two. In some cases, if you can prove a twelve-month history of LTR or STR rental income, you can qualify off that rather than the appraiser’s market rent.

Step 2

Next, you’ll need to find your annual debt. Your annual debt for loan qualification purposes equals the total annual principal, interest, taxes, insurance, and HOA (if applicable) payments. Annual Debt = Total Annual PITI payments.

Step 3

Next, you’ll divide your annual gross rental income by your annual debt for your ratio. DSCR = Annual gross rental income/Annual debt.

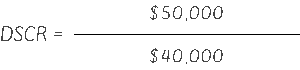

Example of Debt Service Coverage Ratio Calculation

A real estate investor might be looking at a property with a gross rental income of $50,000 and an annual debt of $40,000. When you divide $50,000 by $40,000, you get a DSCR of 1.25, which means that the property generates 25% more income than what is necessary to repay the loan. This also means that there is a positive cash flow in the lender’s eye.

How to Improve Your DSCR

Improving your DSCR before applying for a loan can increase your chances of approval and the amount you qualify for. Here’s how you can optimize your DSCR to make yourself more qualified when applying:

Increase rental income:

Boost your rental income by optimizing your property’s occupancy rates, increasing rental rates in line with market trends, or offering additional services or amenities to attract more tenants. Minimize vacancies by implementing effective marketing strategies, maintaining properties in good condition to attract and retain tenants, and quickly addressing tenant concerns or issues.

Refinance existing loans:

Explore opportunities to refinance existing loans at lower interest rates with longer repayment terms and consider adding an interest-only feature. Refinancing your existing mortgage reduces your monthly debt service obligations and improves your DSCR.

Increase property value:

Invest in property upgrades or renovations to increase its market value, allowing you to command higher rental rates and improve your overall financial position. Upgrades can also help attract tenants, helping you increase your rental income by reducing vacancies.

Manage your expenses:

Implement cost-saving measures like energy-efficient upgrades, outsourcing maintenance services, or renegotiating vendor contracts to reduce operating expenses. The lender does not consider expenses when calculating your DSCR but this will help you improve your overall cash flow.

What Are DSCR Loans?

A DSCR loan is one of several types of home loans referred to as Non-QM loans. Non-QM loans provide potential borrowers with an alternative route to financing, which doesn’t require traditional income verification methods. A DSCR loan, in particular, makes it easier to show rental income that might not show up on your taxes due to deductions for legitimate business expenses.

A DSCR loan is a strong Non-QM loan for real estate investors. Lenders can use a DSCR to help qualify real estate investors for a loan because it can easily determine the borrower’s ability to repay without verifying personal income.

When it comes to Non-QM mortgages, DSCR loans are one of the most popular options among all borrowers. In fact, between 2018 and February 2023, DSCR loans accounted for approximately half of the 201,000 Non-QM loans rated by S&P Global.

A DSCR loan enables real estate investors to get a loan because it takes into account cash flow from investment properties rather than pay stubs or W-2s, which many investors do not typically have. Lenders use DSCR to evaluate a borrower’s ability to make monthly loan payments.

Deductions from properties may lower taxable income, making it hard for investors to prove their true income. Lenders use DSCR to determine whether someone can make loan repayments. Otherwise, many investors might struggle to meet the basic eligibility standards for real estate loans.

Since they don’t require pay stubs or tax returns showing minimum income levels, debt service coverage ratio loans are a great alternative for investors who claim many write-offs and business deductions.

Ready to apply for a loan? Contact us today.

How Does a DSCR Loan Work?

Real estate investors are making up more and more of the U.S. real estate market. In fact, investor purchases of U.S. homes increased 3.4% year-over-year in the second quarter of 2024. However, getting the right type of mortgage financing is not always easy as a real estate investor.

Because real estate investors write off expenses on their properties, some may not qualify for a conventional loan. The debt service coverage ratio loan allows these individuals to qualify more easily because they don’t require proof of income via tax returns or pay stubs, which investors either don’t have or don’t represent their true income due to write-offs and business deductions.

Real estate investors looking for home buying tips should consider a DSCR loan because it’s ideal for properties you intend to rent out or otherwise turn into income-generating properties. From renting to a long-term tenant or operating a short-term rental business on Airbnb, there are many situations where a DSCR loan is a good option, especially if you don’t have W-2 income.

Some of the property types you can use a DSCR loan for include:

- Single Family Residences (SFR), including single-family homes, condos, and townhomes.

- Multifamily properties (2-10 Units).

- Rural (acreage limitations apply, and the property’s income must be supported by comparable rents in the area).

Many real estate investors tend to use DSCR loans for rental income properties that allow them to open up new revenue streams. If you’re interested in purchasing or building a property and unsure about whether you can use a DSCR loan to do so, reach out to Griffin Funding. We can help you decide whether a DSCR loan is right for you.

Why Does DSCR Matter?

The debt service coverage ratio provides the lender with a metric that helps them gauge a borrower’s ability to pay off their DSCR mortgage. Lenders must forecast how much a real estate property can rent for so that they can predict a property’s rental value.

If you have a DSCR of less than 1.0, it means that a property has the potential for negative cash flow. DSCR loans can still be made on properties with a ratio below 1.0, however these are usually purchase loans with home improvements, upgrades, or remodeling to be made to increase the monthly rent or for homes with high equity and potential for higher rents in the future. You also can potentially get the property above a 1.0 ratio with a DSCR interest-only loan. Keep in mind that for DSCR loans that we fund, the average property has a DSCR of 1.05.

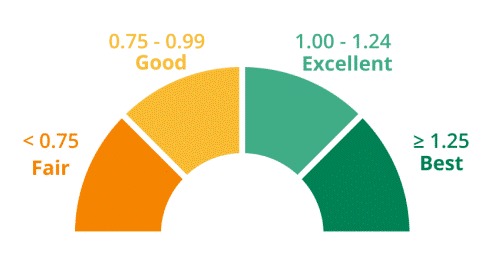

What Is a Good DSCR Ratio?

Many lenders will require a 1.25 DSCR to qualify for a DSCR mortgage loan. However, Wholesale Mortgage Source allows real estate investors to qualify for a loan with a DSCR of less than .75.

Please note that borrowers with a good DSCR ratio can secure more beneficial rates and terms on their loans with fewer requirements. Interest rates are best on DSCR ratios of 1.25 or above, while a DSCR ratio of less than .75 requires more down payment/equity and more reserves to offset the negative cashflow. For example, a DSCR that is 1.00 or higher on a loan of $1,000,000 or less requires a 20% down payment, a 700 credit score, and 3 months of reserves. Whereas a DSCR that is less than 1.00 on a loan of $1,000,000 or less requires a 25-30% down payment, a 700 credit score, and 6-12 months of reserves. Real estate investors can increase the DSCR by choosing an interest-only loan and/or a 40-year term to maximize cash flow.

If you have a DSCR of less than 1.0, it means that a property has the potential for negative cash flow. DSCR loans can still be made on properties with a ratio below 1.0, however these are usually purchase loans with home improvements, upgrades, or remodeling to be made to increase the monthly rent or for homes with high equity and potential for higher rents in the future. You also can potentially get the property above a 1.0 ratio with a DSCR interest-only loan. Keep in mind that for DSCR loans that we fund, the average property has a DSCR of 1.05.

DSCR Loan Requirements

DSCR loans have specific requirements that borrowers must meet to secure this type of loan. The key DSCR loan requirements include:

- Minimum credit score of 620: Borrowers’ credit histories and financial stability are evaluated, although credit requirements can vary depending on the lender and specific loan terms. Borrowers who take out a DSCR loan with Wholesale Mortgage Source have an average credit score of 732, but we can work with borrowers with credit scores as low as 620.

- Minimum loan amount of $75,000: DSCR loans offer loan amounts ranging from $75,000 to $20,000,000, providing a flexible financing option for properties that range in cost.

- Appraisal: An appraisal is conducted to determine the property’s current market value and rental income.

- Property type: DSCR loans can only be used for investment properties that generate rental income. The property you are purchasing or refinancing must be a non-owner-occupied, income-producing investment property used for business purposes. DSCR loans cannot be used on primary residences.

Ready to apply for a loan? Contact us today.

Pros, Cons, and Other Considerations

When considering any type of financing options, it’s essential to weigh the benefits and drawbacks and take any special considerations into account. In the sections below, we go through the pros and cons of DSCR loans, lay out the situations when a DSCR loan may not be ideal, and discuss the unexpected elements that can arise from this type of financing.

Pros and Cons of DSCR Loans

As you determine whether a DSCR loan is right for you, it’s important to weigh the pros and cons. Below, we go into more detail about the benefits of DSCR loans, as well as some of the drawbacks.

Pros

- Accessibility

- Streamlined approval process

- Unlimited cash-out

- No limit on the number of properties

- All types of rentals are eligible

- Borrower in an LLC

- Jumbo DSCR loans

- Flexible qualifying requirements

Cons

- Large down payments

- Higher interest rates

- Limited financing

- For rentals only

- Vacancies

- Prepayment penalties

- No Fixer-Uppers

- Unique Properties

Benefits of DSCR loans

DSCR loans are often easier to qualify for and offer a streamlined approval process because there’s no personal income or job history requirement. Advantages of DSCR loans include the following:

- Accessibility: Your eligibility for a DSCR loan is determined by a single figure: your DSCR. Since lenders don’t consider personal finances, they’re more accessible to all types of borrowers, including novice and veteran investors.

- Streamlined approval process: DSCR loans typically have a streamlined application and approval process, offering faster closing times than other types of investment loans. Since you don’t have to submit personal financial information, the application and underwriting process is straightforward, and approvals are typically much faster.

- Unlimited cash-out: DSCR loans offer unlimited cash-in-hand, which means you can continue taking out money when needed to cover expenses like repairs.

- No limit on the number of properties: DSCR loans allow investors to purchase multiple properties simultaneously. With traditional loans, borrowers are limited by the number of properties they finance. However, with DSCR loans, investors can purchase as many properties as they want to build their portfolios. DSCR loans can also have a multiplier effect. For instance, you can qualify for a loan with one property then once it gains enough equity you can refinance it and use the cash to purchase an additional rental property.

- All types of rentals are eligible: DSCR loans can be used for all types of rentals, such as short—and long-term rentals and various properties, including single—and multi-family homes. Rural properties with limited acres and supporting rental comps are permitted.

- Borrower in an LLC: A limited liability company (LLC) can be used to purchase investment properties for business purposes. Taking out the DSCR loan in the name of an LLC helps protect your personal assets, and if structured properly, the loan will not be reported to your personal credit report. There can be multiple members in the LLC, and not all members need to personally guarantee the loan. DSCR LLC mortgage loans are perfect for real estate syndications. Syndicators can raise money from investors, pool the funds for down payments, purchase investment properties, and use DSCR mortgage loans to finance them.

- Jumbo DSCR loans: Jumbo DSCR loans are ideal for real estate investors who focus on investing in high-end luxury properties. At Wholesale Mortgage Source, we offer jumbo DSCR loans of up to $20,000,000.

- Flexible qualifying requirements: DSCR loans aren’t subject to the strict requirements that conventional loan products must follow, and this allows for more flexibility when it comes to qualifying. Lenders may be able to look past a lower credit score or down payment if there are other compensating factors or if they are presented with a great loan opportunity.

“A DSCR loan is low doc. When you’re applying for a conventional loan, you’re going to be bombarded with a bunch of conditions and requests for income documentation, past employment history, verification of employment, and so on. The docs that are requested are just a lot heavier on a full doc loan, while a DSCR loan keeps the stress lighter on the client throughout the transaction.”

Ready to apply for a loan? Contact us today.

Cons of DSCR loans

Unfortunately, like all types of loans, DSCR loans have some risks and drawbacks that may not make them suitable for every borrower. The cons of DSCR loans include the following:

- Large down payments: Most lenders require a large down payment of 20-40%, which may be higher than some conventional mortgages.

- Higher interest rates: DSCR rates are typically higher because these loans are riskier investments for the lender. Additionally, the lender can require you to pay higher fees; the higher your loan amount, the more those will cost.

- Limited financing: DSCR loans offer amounts from $100,000 minimum to $20,000,000 maximum. If you’re purchasing properties for under $100,000 or an expensive property in a luxury market for over $20,000,000, these loans might not be suitable for you.

- For rentals only: DSCR loans are for buy and hold rental properties only, so they can’t be used for a primary residence or to fix and flip a home. Instead, you can only use a DSCR loan for a property that generates cash flow. If you plan to flip a home, you’ll need another type of mortgage loan.

- Vacancies: It’s normal for rental properties to have vacancies every now and then. However, you’re not generating any cash flow if you have vacancies. Lenders don’t assess your ability to repay your mortgage if your property or units within the property are vacant, so you could end up getting deeper into debt if you’re not consistently generating cash flow. This does not mean that vacant properties do not qualify for DSCR financing; it means that there are additional restrictions and limitations on properties that are not occupied by a tenant.

- Prepayment penalties: Most DSCR loans come with a prepayment penalty ranging anywhere from one to five years. You will get a lower interest rate in most cases if you opt for a prepayment penalty, however there are many different kinds of prepayment penalties so make sure to discuss the details with your loan officer. DSCR loans are available without pre-payment penalties, and pre-payment penalties can be bought out.

- No Fixer-Uppers: The property must be move-in ready for tenants and not in need of major repairs, renovations, or construction. DSCR loans are not for properties that need to be rehabbed. The appraiser cannot mark the appraisal “subject to”.

- Unique Properties: Unique properties, such as rural properties and those that can’t be compared to other like properties around the area, can be difficult to finance using a DSCR loan.

When Not to Use a DSCR Loan

While DSCR loans can be a helpful financing option for many real estate investors, there are certain scenarios in which using a DSCR loan may not be ideal. Here are some cases where a DSCR loan may not be the best choice:

- When purchasing a primary residence: DSCR loans are designed for investment properties rather than primary residences because the DSCR is calculated based on the rental income of the property. If you’re buying a home to live in yourself, you’d likely be better served by exploring traditional mortgage options tailored to owner-occupied properties.

- When you want to purchase distressed property/fix and flip a home: DSCR loans may not be suitable for purchasing distressed properties or for fix-and-flip projects where the intention is to quickly renovate and resell the property for a profit. In these cases, short-term financing options like hard money loans or bridge loans may be more appropriate due to their flexibility and faster funding times.

- When purchasing a property worth less than $100,000: DSCR loans are often more suitable for financing larger real estate investments with higher property values. For properties valued at less than $100,000, the transaction costs and underwriting requirements associated with DSCR loans may outweigh the benefits. In such cases, alternative financing options may be more practical.

Managing DSCR Loan Surprises

When applying for a DSCR loan, several unexpected elements or surprises may arise that you should be aware of, such as:

Prepayment Penalties

Prepayment penalties are fees lenders charge if you pay off your loan earlier than the agreed-upon term by either selling the home or refinancing the loan. The penalties are outlined in the loan agreement and can vary in terms of calculation method and amount. Below are some examples of common ways that prepayment penalties are structured:

- 3-2-1 prepayment structure: The most common type of prepayment penalty structure is a 3-2-1, or step-down, meaning it goes down from 3% to 2% to 1%. With the 3-2-1 structure, if you pay off the loan in year one, you’ll have a 3% prepayment penalty. In year two, you’ll have a 2% penalty, and in year three, you’ll have a 1% penalty. After that, you’ll have no penalty.

- 5-4-3-2-1 prepayment structure: There’s also a 5-4-3-2-1 structure, so your penalty can be anywhere from 1% to 5%, depending on whether you pay your mortgage off in the 1st year or 5th year.

- 6 months of interest: Depending on the number of years the prepayment penalty is structured, typically 1 to 5 years, you’ll have a penalty equal to 6 months of the interest portion of your mortgage payment if paid off before the prepayment period.

Applying for a DSCR Loan

As an experienced DSCR mortgage broker, Wholesale Mortgage Source offers a streamlined application and approval process. Additionally, you’ll receive excellent support and customer service from our team of loan officers as you navigate the DSCR application process. Whether you’re interested in purchasing an investment property to attract long-term renters or you want to set up a short-term vacation rental business, read on to learn more about the basic steps involved in applying for a DSCR loan.

How to Apply for a DSCR Loan

To apply for a DSCR loan, the first step is finding a bank or lender with a robust DSCR loan program. Wholesale Mortgage Source offers DSCR loans and has a history of qualifying borrowers at various income levels for small and large investment property loans.

Here’s an overview of how to apply for a DSCR loan with Wholesale Mortgage Source:

How to get a DSCR Loan

- Fill out a loan application

- Calculate your DSCR

- Lock in your interest rate

- Get approved

- Loan is funded

- Fill out a loan application: Once you’ve chosen a reputable lender, it’s time to fill out a loan application. You can quickly apply for a DSCR loan Wholesale Mortgage Source using our online application, or you can call our office and have one of our Sr. Loan Officers fill out the application with you over the phone.

- We will calculate your DSCR: We will calculate the DSCR and fill out a rent schedule. Your DSCR will impact the interest rate that you qualify for.

- Lock in your interest rate: After calculating your DSCR and reviewing your application, we will offer you an interest rate for your loan. You can lock in this interest rate as we proceed through the final steps of the loan approval process.

- Get approved: Close the loan. You don’t need to bring proof of personal income or other information about your financial history. DSCR loan requirements are less stringent than traditional loans, making the closing go much faster.

- Loan is funded: Once the loan is approved, we will quickly fund it and deposit the loan amount into your escrow account.

Upon approval for our DSCR loan program, you’ll receive an estimate of the interest rate, closing costs, and monthly mortgage payments. Prepare to pay for an appraisal and undergo the underwriting process prior to signing the closing documents. The underwriting process includes credit report review, appraisal, rental income verification, title search, and a final underwriting decision.

How to Get a DSCR Loan on a Short-Term Rental

DSCR loans aren’t just used to finance long-term rentals like business offices and apartment complexes; they can be used for short-term rentals like those listed on Airbnb and VRBO. Short-term vacation rentals are a $64 billion market in America, with each listing taking in an average of $26,024 each year. This represents a huge financial opportunity for real estate investors, especially for those looking to buy in areas that are highly desirable for vacations and tourism.

Short-term rentals are income-producing properties, making DSCR loans a perfect solution for investors who want to use the property’s rental income to qualify for the loan. Additionally, by securing a DSCR loan with favorable terms, investors can potentially lower their borrowing costs and improve cash flow from their STR properties.

Investors who already own STR properties can also refinance with a DSCR loan to lower their interest rates or access equity through a cash-out refinance. This can provide additional capital for property improvements, expansion, and other investment opportunities.

To qualify for a DSCR loan on a short-term rental property, you typically need to meet certain criteria, such as:

- Minimum credit score of 680

- Minimum DSCR of 1.00

- Minimum down payment of 25% for borrowers with at least 1 year of experiencing STRs

- Minimum down payment of 30% for borrowers with less than 1 year of experience

- Projected annual revenue divided by 12 months to demonstrate sufficient income to cover debts

- Occupancy rate exceeding 60%

- Minimum credit score of 680

- Minimum DSCR of 1.00

- Minimum down payment of 25% for borrowers with at least 1 year of experiencing STRs

- Minimum down payment of 30% for borrowers with less than 1 year of experience

- Projected annual revenue divided by 12 months to demonstrate sufficient income to cover debts

- Occupancy rate exceeding 60%

Ready to apply for a loan? Contact us today.

Why a 203K Loan?

The main benefit of these loans is that they give you the ability to buy a home in need of repairs that you might not otherwise have been able to afford to buy. Plus, the down payment requirements are minimal, and often you get decent interest rates.

- Fixed Rates

- Adjustable Rate Mortgage (ARM)

- Minimal Down Payments

- Terms from 5 to 30 Years